Halal Packaging Market Trends and Regional Data (NA/EU/APAC/LA/MEA) 2025-2035

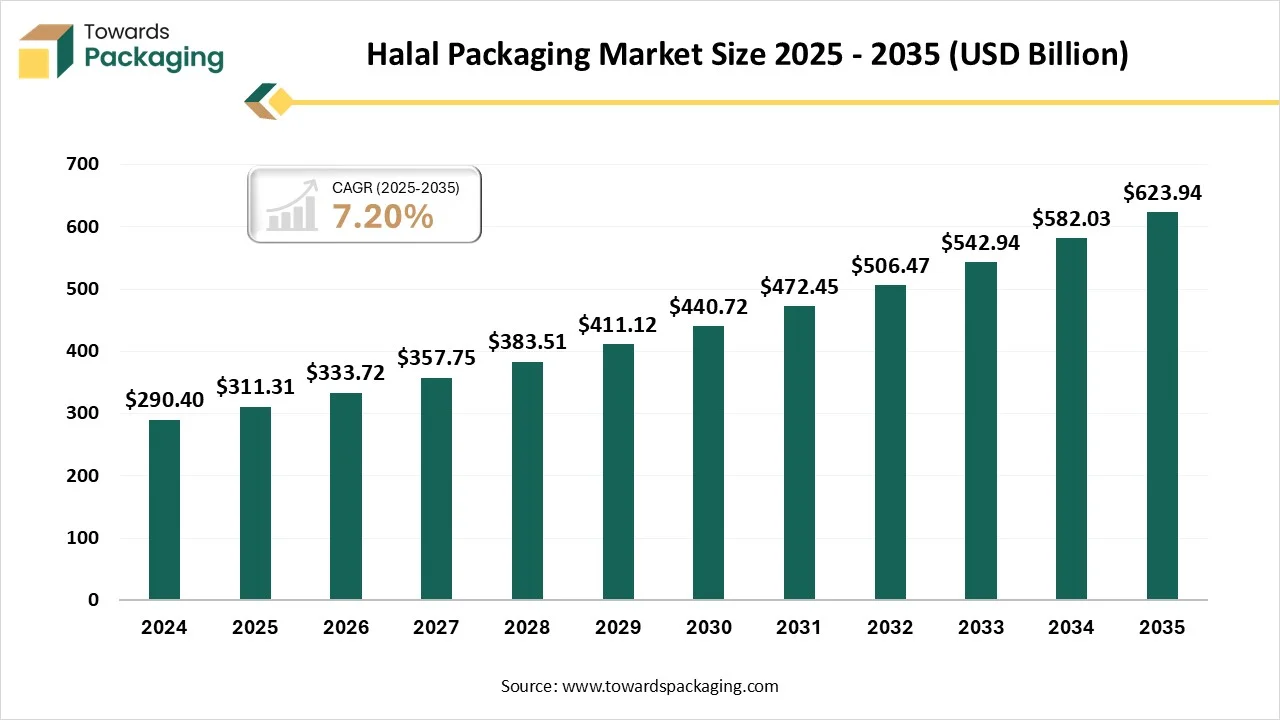

As highlighted by Towards Packaging research, the global halal packaging market, valued at USD 311.31 billion in 2025, is expected to reach USD 623.94 billion by 2035, registering a CAGR of 7.20% throughout the forecast period.

Ottawa, Nov. 28, 2025 (GLOBE NEWSWIRE) -- The global halal packaging market stood at USD 311.31 billion in 2025 and is projected to reach USD 623.94 billion by 2035, according to a study published by Towards Packaging, a sister firm of Precedence Research. The significance of the halal packaging market is driven by a large and rising global Muslim population, growing consumer demand for halal-certified products across numerous industries, and stricter regulations.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by Halal Packaging?

Halal packaging generally refers to packaging materials and even processes that are compliant with Islamic law, also ensuring they are free from "haram" (forbidden) substances along have not been cross-contaminated with non-halal products. This thus applies to the packaging itself, including its raw materials, and even the entire supply chain, from manufacturing to storage and distribution.

With over 1.9 billion Muslims worldwide, there is now a steadily increasing need for products that adhere to Islamic dietary and even hygiene laws, which directly fuels the demand for halal-certified packaging. With over 1.9 billion Muslims globally, there is a steadily increasing demand for products that adhere to Islamic dietary and hygiene laws, which directly fuels the demand for halal-certified packaging.

Government Initiatives for the Halal Packaging Industry:

- Establishment of National Halal Certification Schemes Many governments, such as India with its India Conformity Assessment Scheme (i-CAS) - Halal by the Quality Council of India (QCI), establish a national body and scheme to provide standardized and recognized halal certification.

- Mandatory Halal Certification for Imports/Exports Countries like Indonesia enforce strict regulations requiring all goods, including packaging materials, to obtain halal certification for market entry, thereby driving the adoption of halal packaging solutions.

- Accreditation of Halal Certification Bodies National Accreditation Boards, such as India's NABCB (National Accreditation Board for Certification Bodies), are authorized to accredit third-party certifiers against international standards (e.g., ISO 17065), ensuring credibility and uniformity in the certification process.

- Harmonization of Standards through International Forums Governments participate in international networks like the International Halal Accreditation Forum (IHAF) to work towards aligning diverse national halal standards and reducing trade barriers.

- Development of Specific Sector Guidelines Agencies often develop detailed guidelines for specific product categories (e.g., meat and meat products) that cover the entire supply chain, from production to processing and packaging, to ensure compliance with Shariah law.

- Support for Micro, Small, and Medium Enterprises (MSMEs) Some governments provide accelerated certification processes and assistance programs to help smaller businesses comply with halal requirements, thereby fostering inclusive industry growth.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5871

What are the Latest Trends in the Halal Packaging Market?

-

Increased Use of Sustainable and Eco-Friendly Materials

There is a significant shift towards using materials such as biodegradable plastics, recycled paper, and a few eco-friendly options to work with both halal principles and even environmental concerns. Technologies such as QR codes, RFID, and blockchain are being integrated to offer consumers easy access to data about a product's halal status. Packaging is being developed with features such as tamper-evident seals and even vacuum-sealed options to prevent cross-contamination as well as protect product integrity, which is a major concern for consumers and manufacturers alike.

What Potentiates the Growth of the Halal Packaging Industry?

-

Integration of Smart Packaging Technologies

Consumers want to easily verify a product's halal status, and even smart packaging offers this direct link to data. Technologies such as QR codes permit consumers to scan and also see details about a product's certification along with its journey. Intelligent packaging can include indicators that monitor and also communicate a product's condition, like temperature, humidity, or the existence of spoilage microorganisms. These assists decrease food waste and even protect consumers, thus by alerting them to issues before a product is consumed.

Regional Analysis

Who is the Leader in the Halal Packaging Market?

Asia Pacific leads the halal packaging market because of a large and growing Muslim population, significant government support as well as regulations, increased international trade of halal products, and a growth in consumer knowledge of halal certification. The region is an important hub for both the supply as well as consumption of halal-certified goods, which boosts innovation in both compliance and even sustainable packaging solutions. Governments in the region have introduced regulations, initiatives, and recognized bodies for halal certification, which impact compliance and market growth.

China Halal Packaging Market Trends

China's market is rising, driven by domestic demand, increased exports, and a strategic position in the worldwide halal economy. Key trends include the growth of sustainable materials, the incorporation of smart technologies for transparency, and even personalized packaging solutions to meet user preferences. The market also emphasizes improved certification processes, advanced materials such as antimicrobial coatings, and even the e-commerce impact on logistics.

India Market Trends

Key trends in the Indian halal packaging industry include the need for sustainable and eco-friendly materials, the acceptance of smart packaging technologies such as QR codes for traceability, and the growth of halal packaging beyond food to include cosmetics, pharmaceuticals, and e-commerce. There is also a focus on improved certification processes for greater standardization and even a rise in personalized packaging solutions.

How is the Opportunistic Rise of the Middle East & Africa in the Halal Packaging Market?

The Middle East & Africa (MEA) region presents a significant and rising opportunity in the halal packaging, propelled by a large Muslim population, growing consumer awareness of halal standards, and even supportive government regulations. The market is expanding fast as demand for halal compliance extends beyond food to pharmaceuticals, cosmetics, and other packaged goods. Consumers are thus becoming more conscious of the entire supply chain, from sourcing to packaging, and even actively seek clear labeling and certification to guarantee product integrity. Halal certification is increasingly seen as a symbol of quality, hygiene, and ethical sourcing, appealing to both Muslim and even non-Muslim consumers.

Egypt Halal Packaging Market Trends

Key trends involve a preference for rigid packaging, mainly metal cans for food exports, and even a growing need for sustainable, transparent, and also traceable materials that meet halal standards. There is a remarkable push for environmentally friendly and even sustainable packaging alternatives that also meet halal requirements, a trend reflected in both the packaging and the wider food industry. Firms are actively investigating and even adopting innovative materials that are both halal-compliant and also sustainable to meet evolving consumer and regulatory demands.

More Insights of Towards Packaging:

- Skin Packaging Market Size, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Companies & Competitive Landscape 2024-2034

- Packaging Printing Market Size, Segment Data, Regional Outlook (NA, EU, APAC, LA, MEA), Company Profiles

- Returnable Glass Bottles Market Size, Share, Segments, Regional Insights (NA, EU, APAC, LA, MEA), Key Companies, and Competitive Landscape 2025-2034

- Pharmaceutical Contract Packaging Market Size, Share, Trends, and Global Forecast 2024–2034

- Bulk Container Packaging Market Size, Segments and Regional Outlook 2025–2034

- Contract Packaging Market Size (2025-2034), Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Companies, Competition, Value Chain & Trade Data

- Connected Packaging Market Size, Segmentation, Regional Outlook, and Competitive Landscape, 2025-2034

- FMCG Packaging Market Size, Share, Trends, Segments, and Forecast 2025-2034

- Nanotechnology Packaging Market Size, Share, Trends, Segmentation, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, and Forecast 2025-2034

- Metalized Flexible Packaging Market Size, Share and Segmental Analysis by Region, 2025-2034

- Pet Care Packaging Market Size, Growth Insights, and Key Companies Leading the Industry

- Form-Fill-Seal Packaging Market Size, Segments Data, and Regional Insights (NA, EU, APAC, LA, MEA)

- Alcoholic Beverage Packaging Market Size, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Single-use Packaging Market Size, Segments, and Regional Dynamics (North America, Europe, APAC, LA, MEA)

-

Meat Packaging Market Size, Segments Data, Regional Analysis & Competitive Landscape

Segment Outlook

Packaging Type Insights

Why did the Primary Packaging Segment Dominate the Halal Packaging Market in 2024?

Primary packaging, like bottles, jars, and pouches, is the even first point of contact with the product. Its supremacy stems from its vital role in preventing any cross-contamination with non-halal substances during storage, production, and handling. Consumers are increasingly seeking transparency. Primary packaging offers a visible and tangible assurance to consumers that the product has been managed according to halal requirements and even has not been compromised.

By using materials such as bottles, jars, and cans, primary packaging protects products from external factors such as moisture, light, and even physical damage that could compromise their halal status.

The secondary packaging segment is considered the fastest-growing in the market during the forecast period.

Secondary packaging offers a large surface area for displaying vital halal certifications and product information, which is crucial for consumer trust and even brand building in a competitive market. Beyond just aesthetics, secondary packaging such as cartons and stretch film is essential for protecting products during transportation and even storage, offering a necessary layer of security and even containment for numerous halal-certified goods.

Material Type Insights

Why did the Plastic Segment Dominate the Halal Packaging Market in 2024?

Due to its versatility, cost-effectiveness, and even ability to meet halal compliance standards via a range of barrier properties that protect product integrity. Its ability to be molded into few shapes and even sizes make it a cost-effective and practical preference for various products in the pharmaceutical, food, and cosmetic sectors. Plastic provides superior barrier properties against moisture and external damage, which is vital for maintaining the integrity, safety, and also shelf life of halal-certified food, pharmaceutical, together with cosmetic products.

The paper & paperboard segment is the fastest-growing in the market during the forecast period.

Due to a combination of versatility, sustainability, and consumer demand. Its eco-friendly nature is a huge driver, as it is recyclable and biodegradable, thus appealing to environmentally conscious users and businesses. Paper and paperboard also meet high-quality and even safety standards for products, making them ideal for food, beverage, along pharmaceutical applications where halal compliance is vital.

Paper and paperboard are versatile materials that can be adapted for numerous packaging needs, from simple boxes to premium and even high-definition printed cartons for cosmetics as well as pharmaceuticals. This adaptability makes it a preferred choice over many industries.

Packaging Technology Insights

Why did the Conventional Packaging Segment Dominate the Halal Packaging Market in 2024?

It best preserves product integrity, prevents contamination, and even offers superior protection against external factors such as moisture and physical damage. Rigid formats like bottles, jars, and cans are crucial for maintaining halal integrity during production and throughout the supply chain. Primary packaging is also dominant as it is the first, most vital layer of protection for halal-certified products that demands direct contact.

Conventional materials such as plastic are versatile, cost-effective, and can even be manufactured under strict regulations to meet halal standards, making them a widely used alternative across various industries such as food, pharmaceuticals, and cosmetics.

The sustainable / biodegradable packaging segment is the fastest-growing in the market during the forecast period.

Due to increasing consumer need for environmentally friendly products, which works with the broader halal principles of ethical along responsible consumption. Halal principles extend beyond just religious compliance to include responsible consumption, ethical production, and environmental protection, which inherently support the usage of sustainable packaging. By utilizing biodegradable and sustainable packaging, thus, halal brands can differentiate themselves in the market and also appeal to a broader range of users who prioritize sustainability alongside ethical sourcing and even certification.

Application Insights

Why did the Food & Beverage Segment Dominate the Halal Packaging Market in 2024?

Due to the high need for halal-certified consumables from the large as well as growing Muslim population, increasing knowledge of non-compliant packaging materials, and the growth of distribution channels for packaged goods, there is a demand for a solution. Halal standards dictate specific demands for packaging materials, production processes, and hygiene, which directly drives the demand for specialized, certified packaging solutions.

The cosmetics & personal care segment is the fastest-growing in the market during the forecast period.

Due to rising consumer requirement for natural, ethical, and even high-quality products, the global expansion of the Muslim population, and even the appeal of halal-certified products to non-Muslim consumers, the market is anticipated to grow. Increased user health consciousness, a preference for cruelty-free products along with transparent sourcing, and greater accessibility via e-commerce and social media also led to this expansion.

Beyond religious compliance, halal certification works with many ethical consumer values, which include cruelty-free, vegan, and also sustainable practices. This broadens the appeal to a broader audience, not just Muslims.

Distribution Channel Insights

Why did the Direct Sales Segment dominate the Halal Packaging Market in 2024?

The largest segment is food and beverages due to the global expansion of the Muslim population and their need for halal-certified products. Consumer knowledge of halal certification, even among non-Muslims, is rising due to perceived quality and hygiene advantages. Manufacturers have expanded their offerings beyond conventional halal foods to include many processed goods, increasing the need for specialized packaging.

The online / e-commerce platforms segment is the fastest-growing in the market during the forecast period.

Due to increased consumer need for convenience, the growth of halal e-commerce platforms, and even greater accessibility to a wider variety of products. These platforms permit consumers to easily verify, browse, and even purchase halal-certified products online, fostering trust via digital verification tools along with detailed product information. Digitalization has also made it easier for niche as well as premium products to reach consumers, speeding sales growth and also encouraging packaging innovation.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in the Global Halal Packaging Industry

- In October 2024, ENVIPLAST received Halal certification for biopolymers. Enviplast, an Indonesian manufacturer of biopolymer compounds, declared that it has acquired halal certification for its materials, even reinforcing its role as a trusted halal-compliant supplier and thus to the packaging and production industries.

Top Companies Halal Packaging Market & Their Offerings

- Pacmoore Products Inc Pacmoore offers halal-certified contract food manufacturing and packaging services, ensuring that all production processes and materials adhere to strict Islamic dietary laws.

- Albea Indonesia All of Albéa's plants in Indonesia are officially halal certified, offering halal-compliant cosmetic, skincare, and personal care packaging solutions.

- Amcor plc Specific facilities, such as Amcor Flexibles India Private Limited, have obtained halal certification for their products, enabling them to meet the demands for halal-compliant packaging in various regions.

- Rootree Rootree offers halal-certified bags and pouches, including new halal spout pouches for liquid packaging, catering to the food & beverage and cosmetics sectors.

-

AIE Pharmaceuticals, Inc AIE Pharmaceuticals is a key player in the halal packaging market within the pharmaceutical sector, where certification is crucial for regulatory compliance in specific regions.

Segments Covered in the Report

By Packaging Type

- Primary Packaging

- Bottles & Jars

- Pouches & Sachets

- Blister Packs

- Trays & Containers

- Cans & Cartons

- Secondary Packaging

- Boxes & Cartons

- Wraps & Sleeves

- Labels & Sleeves with Halal Certification

- Tertiary Packaging

- Pallets & Crates

- Stretch Wraps & Films

By Material Type

- Plastic

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Bioplastics / Compostable Plastics

- Paper & Paperboard

- Kraft Paper

- Corrugated Board

- Coated Paperboard

- Metal

- Aluminum

- Tinplate

- Glass

- Clear Glass

- Amber Glass

- Others

- Biodegradable & Recycled Materials

- Composite / Multilayer Materials

By Packaging Technology

- Conventional Packaging

- Aseptic & Sterile Packaging

- Modified Atmosphere Packaging (MAP)

- Active & Intelligent Packaging

- Sustainable / Biodegradable Packaging

By Application

- Food & Beverage

- Meat, Poultry & Seafood

- Dairy Products

- Bakery & Confectionery

- Ready-to-Eat / Frozen Foods

- Beverages (Juices, Soft Drinks, Water)

- Pharmaceuticals & Nutraceuticals

- OTC Drugs

- Capsules & Supplements

- Herbal / Traditional Medicines

- Cosmetics & Personal Care

- Skincare & Haircare Products

- Perfumes & Deodorants

- Toiletries

- Others

- Household & Cleaning Products

- Healthcare Supplies

By Distribution Channel

- Direct Sales (B2B / OEM Contracts)

- Distributors & Wholesalers

- The Asia Retail Packaging Suppliers

- Online / E-commerce Platforms

By Region

-

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

-

South America:

- Brazil

- Argentina

- Rest of South America

-

Europe:

-

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

-

Western Europe

-

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

-

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

-

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5871

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight - Check It Out:

- Tea Packaging Market Size, Segmentation, and Growth Forecast (2025-2034)

- Snacks Packaging Market Size, Segments and Competitive Analysis

- Compostable Packaging Market Size, Segments Data, Regional Insights, and Competitive Landscape Analysis

- Plant-Based Packaging Market Size, Segmentation, and Competitive Analysis (2025-2034)

- Wrist Watch Packaging Market Size, Segments Data, and Regional Analysis

- Chocolate Bar Packaging Market Size, Segments Data, and Competitive Landscape

- Ice-cream Packaging Market Size, Segments Data, and Competitive Landscape

- Packaging 4.0 Market Size, Segments Data, and Competitive Analysis

- Primary Packaging Market Size, Segments Data, and Regional Insights (NA, EU, APAC, LA, MEA)

- Poultry Packaging Market Size, Segments Data, and Regional Analysis (NA, EU, APAC, LA, MEA) with Competitive Insights

- Mobile Cases and Covers Market Size, Segments, Regional Data and Competitive Analysis

- Seed Packaging Market Size, Segmentation, Regional Insights and Competitive Dynamics (2025-2034)

- Pesticide Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Returnable Transport Packaging Market Size, Segmentation, and Regional Insights (2025-2034)

-

Packaging Automation Market Size, Segmentation, Regional Insights & Competitive Landscape

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.